GUIDES

INTRODUCTION

Why did we write this guide?

This is the vastest and detailed guide on investing in pre-construction condos in Toronto.Who is this guide for?

This guide is especially for those interested in pre-construction condominiums. We share basics, tips, and deceives about investing in Toronto that work for each level of condominium investor whether you're simply considering going all in, or regardless of whether you have bought new condos before. We feel there is something for everybody.

How much of this guide should I read?

I would recommend reading it all. We have divided this guide into three areas.

Part 1 – Why Pre-Construction and why Toronto?

Part 2 – How to buy Pre-Construction (including the best tips and tricks to getting the best deals)

Part 3 – What Pre-Construction Condos to buy

CHAPTER 1 – Why Invest in Pre-Construction Condos in Toronto?

Before we start talking about anything, it is important to understand why pre-construction condo investing is so popular and what makes it so unique. The first step to investing in new condos is to understand the investment vehicle to make sure that it makes sense for you.

There are many factors that make the Greater Toronto Area such a unique area to invest and we will highlight four key points on why we believe the prices and rentals will continue to grow in the coming years.

Why Pre-Construction Condos?

Pre-construction condominiums have become a very popular form of investment, selling about 20,000 new condos each year. Every year there is a huge demand for the best projects, where investors are expected to get the best returns (we will talk in more detail about how to choose the best projects later in this guide). We invest in many new condos and there are many reasons to turn them into the investment of choice.

Managing multiple condominiums is a passive form of investment and can take very few hours of work.

Why Invest in a Toronto Condominium?

Greenbelt: The Legislation That Changed Everything

In 2005, the province set aside 7,200 square kilometers (known as the "Green Belt") for development, with the goal of conserving and intensifying the land. To help incorporate the size of the Greenbelt into the perspective, it covers a larger area than Prince Edward Island.

The policy has made a big difference in the way developers can use the land within the Green Belt. Prior to 2005, most of the new developments were low-altitude development, but the newly protected land meant that for the first time there was a shortage of land within the Green Belt.

Inside the Greenbelt (or GTA) to construct low-rise buildings outside the Greenbelt (north of Newmarket, etc.).

Greenbelt: Shifting to High Rise

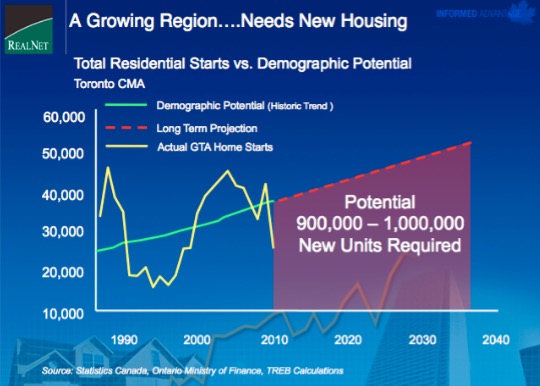

By the mid-1970s, there had always been 40,000 new home sales, but the make-up of developers building had changed.

Since then, each year, on average, the number of school buildings has decreased and the number of school buildings has increased, with a total average of 40,000 ranges. These 40,000 have remained relatively constant since 2000. In the 1970s, the impact of the Greenbelt on the structure of development in the Greater Toronto area was demonstrated in 2007 (two years after the implementation of the Greenbelt).

Source : https://www1.toronto.ca/city_of_toronto/city_planning/sipa/files/pdf/flash_sec2.pdf, Statistics Canada

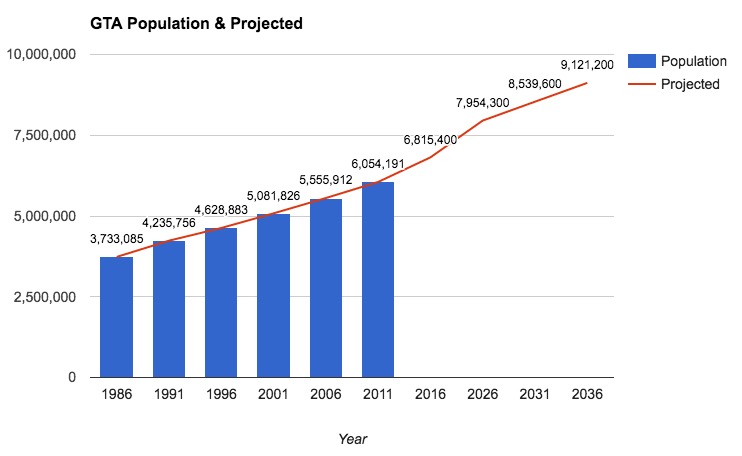

This means that Statistics Canada predicts about 2 million new people in the GTA over the next 20 years, which means we need to build 800,000 new homes (assuming an average of 2.5 people per house) to live in. All of these people meet the need for immigration.

This information, in conjunction with the Green Belt legislation we have already discussed, will mean more density and urbanization, forcing us to continue to “grow up” and not " out”.

Toronto’s growing rental market

The biggest myth is that we make a lot of condos in Toronto. What the “myth” does not take into account is the need for housing in the city. A key factor we are looking at is the rapid growth of the rental market, which has quadrupled in the last 10 years.

Despite the increasing number of rents each year, we also see high pressure on prices, indicating that the demand for rent is still exceeding supply. In 2015, the average rent in Toronto reached $ 1,910.25.

The biggest difference between Toronto and other major cities is that there are no rent restrictions. This means that for new condominiums, owners are free to increase their annual rent based on market conditions, rather than being linked to rent control laws. This gives the landlord a huge advantage in the Toronto rental market.

In addition to the increase in the number of rental units and rental rates, we continue to have a very tight market for vacant rates. Despite the increase in the supply of new condominiums, the vacancy rate in Toronto is very low (about 1%). This tells us that the number of people entering the city is equal to or greater than the supply of new condominiums under construction.

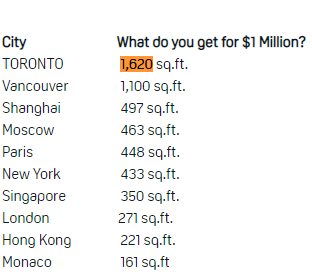

Low prices compared to global cities

Prices in Toronto are relatively affordable, especially compared to the major financial centers in the world. The graph below shows you receive $ 1 million (average) in various major cities around the world.

The graph shows how Toronto compares to other major cities with a starting price of just over a million dollars. In Monaco, probably the most expensive real estate market in the world, your suite will be 10 times smaller than Toronto for the same price. What does this data tell us?

In the case of large financial center cities, Toronto is still relatively affordable

Toronto still has a lot of space as jobs return to the core and the public sphere improves as the population grows.

This is one reason why foreign investors see Toronto as a place to park their money.

Chapter 2 - How to Successfully Buy Pre-Construction Condos in Toronto

Anyone can walk into a sales office and buy a new first argument. Expert investors take their time, wait for the right opportunity, and respond quickly when available. In this next chapter, we will explore the biggest mistakes new condo investors make (often costing thousands of dollars) and how to avoid them. We will teach you the secrets of the condo industry in Toronto, help you take advantage of it, and buy the best units at the best prices.

Pre-Construction Contos: Time is everything

One of the biggest secrets of the Toronto condo industry: time is everything. You can study all the worksheets and research all the places around the condo and micro-analyze all the details to make sure your vision is safe; If you buy at the wrong time, you can put thousands of dollars on the table. Remember, you make money on real estate by giving, not by selling.

Developers must sell 75% of the condo project in advance

To understand how to utilize developers to get the best price, most developers in Toronto need to understand that 75% of their condo must be sold in advance before receiving construction funding (i.e., before a bank lends money to developers to build a tower).

Platinum Launch - Buy early to save money

When a developer starts a new condo project, they usually do it in 5 steps (note that each developer has a slightly different way to start their project - however, the following is the sum of what we see on the market). The condo launch cycle is a proven and reliable way for developers to sell projects, and it is important for investors to understand.

There are usually 5 different launches, selling the best suits as you go through the launch cycle, increasing developer prices, and removing incentives (meaning you buy later, "often you pay more for the rest"). Suites ”after selecting all the best).

The five launches are:

Developer friends and family Platinum Launch - Best Agents Invited To Sell At Best Price VIP Launch - 300 to 500 agents invited to sell Any Agent - Invites 40,000 agents of the Real Estate Board Public Opening - Anyone who has registered directly with the developer or the public is invited

In general, if you are asked to buy directly with the developer or you can go to a sales office, you may have 5 "launches" in front of you and it seems that you are looking for high priced remaining suits.

As you can see from the graph, the cost of all three projects increased over time with each launch. The "Red Line" (referring to a project located in Down's own area) grew from about $ 330,000 to about $ 430,000 between the first and last launches - the same sequence, 000 100,000 difference, but at the wrong time.

Similarly, the “green line” referring to a project in the recreation district experienced a significant jump between launches one and two but remained stable among the remaining launches. However, if you do not buy at the right time, you may have paid more than 000 40,000 for the same suite as your neighbor.

These are real examples of price increases, sometimes in days or weeks. This is what we mean by “TIME IS ALL” to successfully invest in a condo before construction.In general, the earlier you can sign in, the better.

Why don't developers sell directly to the public?

We often get this question. It is assumed that a buyer who enters the sales office without an agent will be able to purchase even a discount directly from the builder (because the developer agent will save on commissions). However, there are a number of reasons why developers do not reach the public quickly.

Developers value their relationship with agents - especially platinum agents. Platinum agents have great sound (media, online, etc.) and sell a lot of condos to developers, so it is important for developers to maintain a strong relationship with these agents.

Marketing to the public is very expensive - many developers who are able to sell through the agent community will do very little mass marketing to reach the public. Unlike mass marketing (radio, TV, online, etc.), developers can budget their marketing costs more accurately (which becomes a percentage of the selling price as a commission to agents). ) It will cost millions of dollars and the results are not sure.

Distribute Marketing Dollars - Agents (especially Platinum Agents) spend money on market projects on behalf of the developer. Giving Platinum Agents “quick access” to a project means that it is not the developers but the agents who will spend the biggest amount to promote their projects.

If you went directly to a developer to buy in the first place, you are likely to hear about the project from an agent who marketed the project for the developer. Developers know about it and protect the agents who work with them

Fact: There are two great times to buy into a primitive startup cycle

We have already addressed that a developer must sell 75% of his project in advance before receiving construction funding. Sometimes a developer will not hit that magic number and will be "stuck" up to 60-65% of sales.

In this case, a developer can set a set of incentives "silently" for a very limited number of suits (usually the number of sales required to receive funding). In this case, the developers offer very favorable terms to buyers who can act quickly (offering suits lower than the Platinum launch).

Here are some notes on these types of transactions:These types of transactions are rare, but they do occur (usually 2-4 times a year).In most cases, there are very strict guidelines on how to advertise these offers. The developer does not want to bother real buyers who can pay more Such offers are usually advertised orally or through platinum agent channels. The best way to access such offers is to subscribe to our Club Insiders. Such sales will not take place on basic projects where there is no problem to reach 75% of sales.

Working with a Platinum Agent

"Platinum Agent" is an industry term used to describe agents gaining frontline access to new condominium launches. These agents often receive preferential treatment from developers because they sell large quantities of condominium and are widely commercially available.

There are several benefits to working with a platinum agent when purchasing a new condominium.

Great access to new projects, great suits, and great pricesPlatinum agents are knowledgeable about the projects when they meet with the developers before starting the project.Platinum agents usually have a direct line with developers or project managers responsible for allocating units (this allows you to secure the suites you are interested in).

Is the "Platinum Agent" a gimmickt?

In short, no. There are many rewards to working with a Platinum Agent on a new project. Agents who sell large quantities of units receive priority treatment from developers and sales managers.

If you are not working with a Platinum Agent when purchasing a new premise:

You may be working with an agent who is not familiar with the internal workings of a new privatization initiative.

Possibilities for you to work with an agent who may not be able to secure the suite you are interested in (we have seen, again and again, buyers give their follow-up requests to agents who have not had the opportunity to get units. On the one hand platinum agents are unable to sell)

At the beginning of a new first argument, you are unlikely to buy or pay a higher price and/or reap some benefits.

3 Common Mistakes Most Condominium Investors Make

This chapter deals with the process of purchasing a new condominium. Before looking at condominium projects, you can make many common mistakes in this process which costs you thousands of dollars and can be easily corrected if you arm yourself with the right knowledge.

1. Buy at the wrong time

If you've taken something from this guide, build it this way. When buying a pre-built condominium at GTA, time is of the essence. It can cost you tens of thousands of dollars to buy into a new condo project at the wrong time, so it’s important to know at what point you buy and work with someone you trust. At what point in the developer sales cycle is the sale.

2. Buy with the wrong agent

Platinum Agents in Toronto is not just a marketing gimmick. This is a very real thing. Developers and sales teams work with agents who support their projects, providing the best treatment and allocation of the best suits while providing pricing and incentives.

We’ve seen many frustrated buyers who are willing to buy but can’t get the same access as someone who works with a platinum agent. Working with the right agent is the equivalent of getting a fast lane pass in Wonderland, Canada.

3. Don’t wait for the right opportunity

When we often meet new investors who are eager to invest, we tell them to be careful and wait for the right opportunity.We know that timeliness is everything, so what sets an active investor apart from a reactive investor is being prepared for the best projects and being able to jump on them fast.

Chapter 3 - Identifying the best Pre-Construction Condo Investments

There are dozens of new condo launches every year, which will greatly help you to explore all the options and decide which projects you should invest in. Less than 5% of new condo launches are eligible investments, and the truth is that they meet our standards when it comes to picking up our investors.

The best new startup project is hard to identify, but easy. We mean, it's scary, but if you focus on your efforts and use certain criteria, the long list of those first projects will be very short.

This criterion is not only revolutionary but also refers to real estate 101 - the investment must be made by a good developer in a great place and give incredible value. Below is a quick Wen diagram of how these three critical aspects of a new condo project interact with each other.

Developer - Always buy from a reputable developer

Buying pre-build means you are buying a piece of paper with the promise of being able to produce marketed products in the future. A large part of the risk of investing in condominiums before construction is that the developer believes they will keep their promises when they are offered.

More importantly, a good developer will be on your side if you have any issues after the project is completed.

How do you know the developer is a gentleman?

There is no single source to say whether a developer is a gentleman or not. Platinum agents have extensive knowledge of well-known developers and non-professionals in the industry. There are a handful of useful resources that a buyer can consider, including:

TARION: TARION is a third party warranty company to which every developer responds. They monitor complaints and issues that buyers may have with a manufacturer in the past. You can search for a manufacturer in the Ontario Builders directory that lists how many homes they have built in the last 10 years and if there are any claims with Tarian during the same period. TARION also has two annual awards: the Employee Choice Awards (Owners Voted) and the TARION Award of Excellence.

The image above shows Tarian's research from UrbanCorp, a notorious bad developer who recently went bankrupt. A quick search of Tarion's website should send red flags with high billable compromises and dollars paid on claims.

Build: Build is an association between the building industry and spatial planning. Every year, they organize build awards, which reward the best developers this year. This is a great way to see which developers are being paid by their peers.

Here are some examples of the best condo developers:

Tridel

Great Gulf Homes

Canderel Residential

Daniels Homes

CentreCourt Developments

Menkes

Liberty Development

Bazis International

Plaza

Location - Always buy where possible

Everyone knows the old real estate proverb “place, place, place” and this is true when investing in pre-construction. When you buy a condominium, it is important to understand that you are investing in a lifestyle. Once you understand this basic, it will be much easier to choose what a good timeshare location is. To identify potential neighborhoods and primitive developments, consider some of the following tips:

Tip: Always check Waxcore and TransitScore. They give an excellent overview of what is close to the condominium

Close to work - Many people now want to get closer to work, so it is important to focus on areas close to major employment centers: financial districts, hospitals, and universities.Near universities - a great source of rent for students and university professors. Nearby universities offer excellent monthly cash flow from a rental perspective and are also very popular investment options.

Near transit - Transit lines are more important. A location close to major public transport lines (especially metros or trams) is important for new condo projects.

Look for investments to improve the neighborhood - look at where the government and developers are investing to improve the infrastructure (e.g. the new Downtown Own Relief Line project in East Toronto), or create new neighborhoods such as Yont & Yong Pont, East Bay Subject to change). I want to invest in the best neighborhoods in Toronto Value - Always know your numbers When evaluating your new first purchase, there are three different puzzles you need to evaluate to make sure you get the big picture. Analyze in relation to other pre-construction condo projects available

When a new condominium is completed, resale prices and rental rates will be higher than the current market because buyers and renters want to be in the “new” building in the vicinity. Investors can earn better returns, especially when compared to pre-construction condos in the rebuilding market, and can buy below existing condos.

Analyze vs. other pre-construction condo projects available

The first step is to identify other condominium projects that any buyer might consider. We are looking for three main pieces of information.

Percentage of sales for nearby projects - If other projects have a lot of equipment it could be a bad sign or a red flagPrice of available unitsPrice of units available in relation to the questionable property.

Analyze vs. resale condos in the area

The next step is to examine how prices compare to the resale market. This is the most important part to analyze because it tells us what the real buyers' market offers to live in this neighborhood today.

To get a clear idea of the market position, our analysis team examines nearby projects and compares these figures with questionable condominiums.

Analyze the rental market in the area

The rental market analysis allows us to determine an approximate rental rate to perform unpredictable cash flow analysis to calculate monthly rental income.

Once we have set a rental rate per square foot (at the end of the YC condo we have determined a conservative rental rate of 25 3.25 per square foot), it is important to operate the model using different mortgage assumptions to determine our cash flow ROI.